RESTON, Va. – November 6, 2019 – On the first anniversary of its launch, the Financial Data Exchange (FDX) is announcing widespread adoption of the FDX API, benefitting 5.26 million consumers through a 72-member network that represents the entire financial services ecosystem, collaborating to advance a fair and safe way to support the digital economy.

The Financial Data Exchange was launched in October 2018 to unite the financial industry around a single, interoperable and royalty-free standard for consumer and business access to their financial data, addressing common challenges around the way the industry shares account information and enhancing security, innovation and consumer control.

“Financial data empowers consumers and businesses to make information-driven decisions and helps increase financial literacy. Establishing common, free-to-use standards – such as the FDX API – lowers barriers and widens the availability of services to consumers at all socio-economic levels,” said Don Cardinal, Managing Director of the Financial Data Exchange.

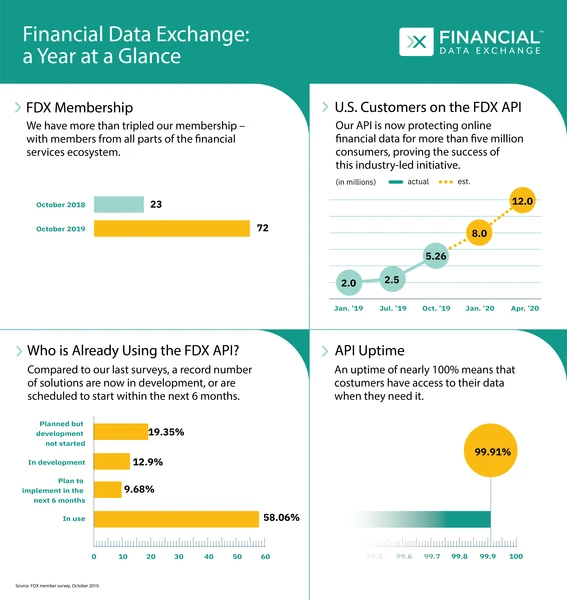

The success of this industry-led approach to establishing a financial data sharing standard is demonstrated by the group’s membership, which has steadily grown through 2019 and now includes 72 members – compared to 21 at launch – and the rapid adoption of the FDX API standard. In January 2019, more than 2 million U.S. customers were empowered through the FDX API. In a recent survey, members reported 5.26 million U.S. customers on the standard and expect to have it rolled out to 8 million customers by year-end and approximately 12 million by April 2020.

This initiative encompasses all voices in the financial services industry, leveraging the knowledge and expertise of providers both large and small. Built on tried and tested practices, implementations of the FDX API across the industry average at 99.91% API availability. An up time of nearly 100% means customers have access to their data when they need it.

“The FDX API standard keeps the financial services ecosystem at the vanguard of protecting digital identity and privacy,” said Cardinal. “The continued growth and adoption of this member-driven standard prove the relevance of our organization’s work.“

Cardinal said that the focus for 2020 will be on expanding FDX’s global footprint and continuing to build relationships with international standards bodies that have established best practices in their respective domains, such as recently-formed agreements with the Kantara Initiative and OpenID Foundation.

The financial services industry has been quick to adopt the FDX API standard in response to growing consumer and business demand for control over data. The Financial Data Exchange recently published its Five Principles of Data Sharing – Control, Access, Transparency, Traceability, and Security – which serve both as operating principles for FDX, and as guidelines for the industry on the essential elements of a secure, transparent approach to the sharing of financial data.

“We believe that account owners should have access to their data and be in control of which aspects they want to share,” said Cardinal. “They should know for what purpose their data is used, which parties have access to it, and ultimately have confidence in the security and privacy of their information.

The Financial Data Exchange added ten new members between August 1 and October 31, 2019. The full list of members can be accessed here.

About the Financial Data Exchange

Financial Data Exchange, LLC is a non-profit organization dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for secure and convenient consumer and business access to their financial data. FDX empowers consumers through its commitment to the development, growth and industry-wide adoption of the FDX API, according to the principles of control, access, transparency, traceability and security. Membership is open to financial institutions, fintech companies, consumer advocacy groups, and other industry participants. FDX is an independent subsidiary of FS-ISAC. For more information and to join, visit the FDX Membership page.